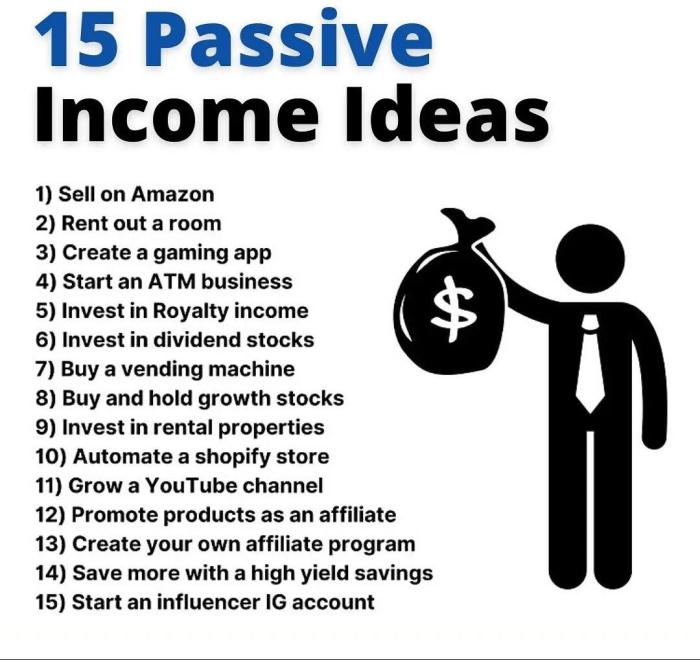

Passive Income Ideas takes center stage as we dive into the realm of making money effortlessly. Get ready to explore various avenues of generating income without active involvement, all while keeping it real with an american high school hip style twist.

Whether you’re intrigued by real estate investments, online business ventures, dividend stocks, or peer-to-peer lending, this guide will provide you with valuable insights and tips to kickstart your journey towards financial freedom.

Passive Income Ideas

Passive income refers to money earned with minimal effort on a regular basis, such as through investments, rental properties, or online businesses. The beauty of passive income is that it allows you to make money while you sleep, freeing up time for other pursuits. Diversifying passive income streams is crucial to reduce risk and maximize earnings.

1. Dividend Investing

Investing in dividend-paying stocks can provide a steady stream of passive income as companies distribute profits to shareholders.

2. Rental Properties

Owning rental properties and collecting rent from tenants is a classic way to generate passive income over time.

3. Peer-to-Peer Lending, Passive Income Ideas

Platforms like Lending Club allow you to lend money to individuals or businesses and earn interest on the loan repayments.

4. Create an Online Course

Developing and selling online courses on platforms like Udemy or Teachable can generate passive income from course sales.

5. Affiliate Marketing

Promoting products or services through affiliate links and earning a commission on sales made through your unique referral link.

6. Create a Mobile App

Developing a mobile app and monetizing it through ads, in-app purchases, or subscriptions can provide passive income.

7. High-Yield Savings Accounts

Putting your money in high-yield savings accounts or certificates of deposit can generate passive income through interest payments.

8. Invest in Real Estate Investment Trusts (REITs)

REITs allow you to invest in real estate without the hassle of property management while earning dividends.

9. Write and Self-Publish an eBook

Authoring an eBook and self-publishing it on platforms like Amazon Kindle can generate passive income from book sales.

10. Start a Blog or YouTube Channel

Creating content on a blog or YouTube channel and monetizing it through ads, sponsorships, and affiliate marketing can lead to passive income over time.

Real Estate Investments

Real estate investments can be a lucrative source of passive income for individuals looking to build long-term wealth. By purchasing rental properties, investors can generate monthly rental income while also benefiting from potential property appreciation over time.

Pros and Cons of Investing in Rental Properties

- Pros:

- Steady Cash Flow: Rental properties can provide a consistent stream of passive income each month.

- Property Appreciation: Real estate values tend to increase over time, allowing investors to build equity.

- Tax Benefits: Investors can take advantage of tax deductions on mortgage interest, property taxes, and depreciation.

- Cons:

- Property Management: Dealing with tenants, maintenance, and repairs can be time-consuming and stressful.

- Market Risks: Real estate values can fluctuate, and rental demand may be affected by economic conditions.

- Liquidation Challenges: Selling a rental property can take time and may involve transaction costs.

Tips for Beginners in Real Estate Investments

- Start Small: Begin by investing in a single property to gain experience and learn the ropes of property management.

- Research Market Trends: Understand the local real estate market to identify areas with high rental demand and potential for growth.

- Secure Financing: Explore different financing options to fund your investment, such as mortgages, private loans, or partnerships.

- Hire Professional Help: Consider working with a real estate agent, property manager, or accountant to navigate the complexities of real estate investing.

- Stay Committed: Real estate investing requires a long-term commitment, so be prepared to ride out market fluctuations and challenges along the way.

Online Business Ventures

In today’s digital age, starting an online business can be a lucrative way to generate passive income. With the right idea and strategy, online businesses can run on autopilot, allowing you to earn money while you sleep.When it comes to online business ventures for passive income, there are endless possibilities. From e-commerce stores to affiliate marketing websites, the key is to find a niche that aligns with your interests and expertise.

Here are some examples of successful online businesses that generate passive income:

Dropshipping Business

Dropshipping is a popular online business model where you sell products to customers without holding any inventory. Instead, you partner with suppliers who handle the storage, packaging, and shipping of products directly to the customers. This hands-off approach allows you to focus on marketing and growing your business while earning a profit margin on each sale.

Print on Demand Business

Print on demand is another passive income idea where you create custom designs for products like t-shirts, mugs, and phone cases. When a customer places an order, the product is printed and shipped directly from the manufacturer. With no upfront costs or inventory management, print on demand businesses can be a great way to earn passive income.

Affiliate Marketing Website

Affiliate marketing involves promoting products or services from other companies and earning a commission for each sale made through your referral. By creating a niche website or blog with valuable content and affiliate links, you can attract readers and generate passive income through affiliate marketing.Running an online business for passive income comes with its challenges and rewards. While the potential for scalability and flexibility is high, it requires dedication, consistent effort, and a solid marketing strategy to generate significant passive income.

However, with the right mindset and approach, an online business can be a great source of passive income in the long run.

Dividend Stocks

Investing in dividend stocks is a popular way to generate passive income. When you buy shares of a company that pays dividends, you receive a portion of the company’s profits on a regular basis, usually quarterly. This income can provide a steady stream of passive income without requiring active involvement in the business operations.

Benefits of Dividend Stocks

- Reliable Income: Dividend payments are often stable and predictable, providing a consistent source of passive income.

- Long-Term Growth: Companies that pay dividends tend to be more established and have a track record of growth, making them a safer investment option.

- Dividend Reinvestment: Reinvesting dividends can help accelerate the growth of your investment portfolio over time through compound interest.

Strategies for Selecting Dividend Stocks

- Dividend Yield: Look for stocks with a history of consistent dividend payments and a competitive yield compared to similar companies in the industry.

- Dividend Growth: Consider companies that have a track record of increasing their dividend payouts over time, indicating financial stability and growth potential.

- Company Health: Evaluate the overall financial health of the company, including factors like revenue growth, profitability, and debt levels, to ensure the sustainability of dividend payments.

Peer-to-Peer Lending: Passive Income Ideas

Peer-to-peer lending is a popular way to generate passive income by connecting borrowers directly with lenders through online platforms.

How Peer-to-Peer Lending Platforms Work

Peer-to-peer lending platforms act as intermediaries, matching individuals looking to borrow money with investors willing to lend it. Borrowers apply for loans, which are then funded by investors who earn interest on the amount lent.

Risks Associated with Peer-to-Peer Lending

- Default Risk: There is a possibility that borrowers may default on their loans, leading to loss of principal for investors.

- Platform Risk: The platform itself may face financial difficulties or regulatory issues, affecting the returns of investors.

It’s important to diversify your investments across multiple loans to reduce the impact of defaults.

Best Practices for Maximizing Passive Income

- Conduct thorough research on borrowers and their credit history before lending money.

- Start with a small investment amount to test the platform and gradually increase your investments as you gain confidence.

- Regularly monitor your investments and reinvest returns to compound your earnings over time.